You Define

Financial Success

I’ll help you

achieve it

Carl Turner

International Financial Planning & Wealth Management

I’m Carl Turner and you can get to know me better in the video below. I specialise in helping people with an international lifestyle manage their money and protect their wealth.

Here’s what sets me apart:

- Global ExperienceWith more than 18 years of hands-on experience in international finance, I bring a deep understanding of all aspects of international personal financial planning.

- International QualificationsI am equipped with advanced financial qualifications recognised globally, assuring you of my competency and commitment to professional standards.

- Regulated PracticeOperating under the regulatory frameworks of multiple jurisdictions worldwide, I adhere to the highest levels of ethical standards and professional conduct.

- IndependenceAs an independent financial advisor, I am committed to providing unbiased advice and solutions tailored specifically to your unique financial goals and circumstances.

- Dependable PartnerI believe in fostering long-term relationships with my clients, built on mutual trust and respect, and am dedicated to being a reliable partner working for your financial success.

If you’re seeking a reliable financial professional who can navigate the complexities of global markets to help you thrive financially, you’ve come to the right place.

Empowering

your financial Journey

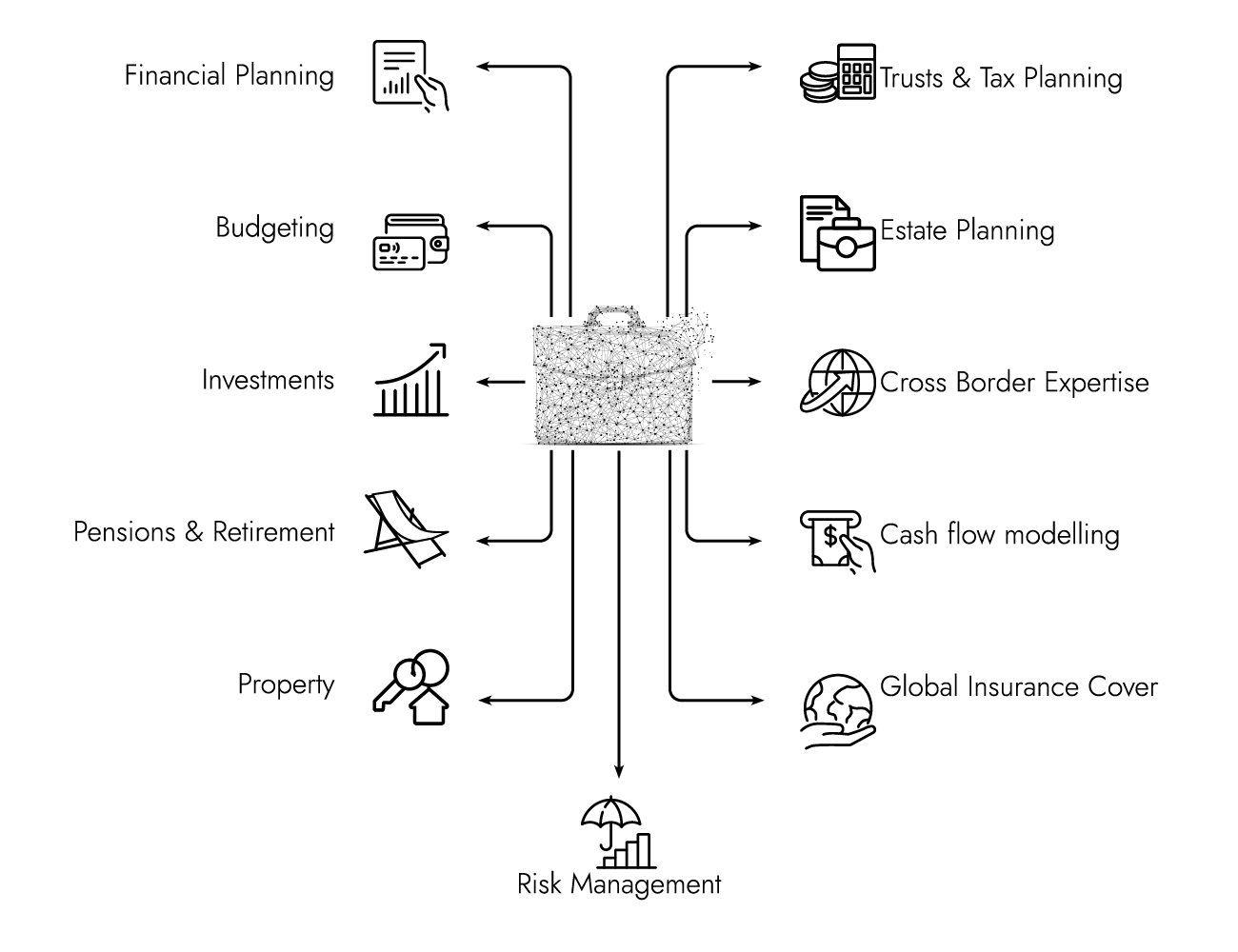

A complete toolkit to protect, manage and grow your wealth

For expatriates and global citizens, navigating the financial landscape can often feel overwhelming. However, you can turn these complexities into opportunities with the proper guidance and a tailored toolkit. I provide my clients with extensive knowledge and resources designed to address an international lifestyle’s unique challenges and benefits. Together, we’ll chart a course towards financial success, simplifying the complex to reach your financial goals.

Who I help

My clients have global lifestyles and cross-border financial interests requiring diligent management to navigate their multi-jurisdictional challenges and take advantage of the opportunities of an international lifestyle.

Executive & Entrepreneurs

Engineers & Project Managers

International Retirees

Individuals & Families

Family Wealth & Trust Funds

What my clients say

A Globally Regulated

Financial

Network

Carl Turner Financial Success is part of of Financial Services Network (FSN), providing our clients access to a global network of first class, fully licenced and regulated financial product providers.

Trusted Worldwide Partners

Sign up to receive my newsletter